Bank of Canada Cuts Interest Rates to 3.75%: What It Means for Homebuyers in 2025

by Justin Negenman

Bank of Canada Cuts Interest Rates to 3.75%: What It Means for Homebuyers in 2025

In a move that’s catching the attention of real estate professionals and potential buyers across the country, the Bank of Canada recently announced a cut in its interest rate to 3.75%. For those thinking about purchasing a home in Calgary, this change could have significant implications—both immediate and long-term.

In this post, we’ll explore how the new interest rate affects buyers, why it presents a unique opportunity in the current market, and what to expect as we move into 2025.

What Does a Lower Interest Rate Mean for Buyers?

When the Bank of Canada lowers its interest rate, it directly influences mortgage rates. For homebuyers, this can lead to lower borrowing costs, making mortgages more affordable. Here’s how it works:

-

Lower Monthly Payments: A reduction in the interest rate means you’ll pay less interest on your mortgage. This translates into lower monthly payments, making homeownership more accessible for a broader range of buyers.

-

Increased Purchasing Power: With lower interest rates, you may qualify for a larger mortgage. This means you could afford a home in a more desirable neighborhood or a property with more of the features you’re looking for.

-

Refinancing Opportunities: For existing homeowners, this is also a great time to explore refinancing your mortgage. Locking in a lower rate can save thousands over the life of the loan.

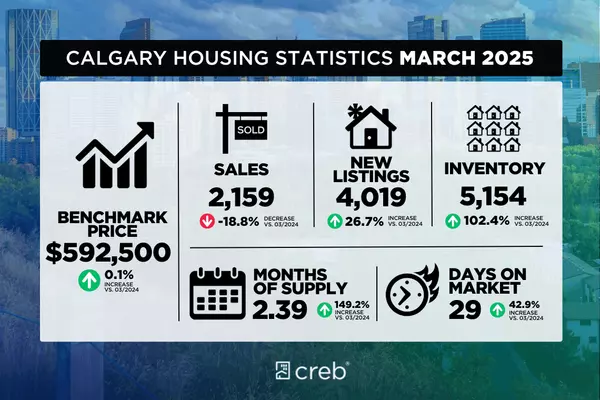

Impact on Calgary's Real Estate Market

Calgary’s real estate market is already buzzing with activity, driven by a combination of economic growth, population increases, and a variety of new housing developments. But how does the rate cut affect the market specifically?

-

First-Time Buyers Have an Edge: For those entering the market for the first time, the new interest rate can provide a much-needed boost. Lower mortgage payments mean that buying may now be more affordable than renting in many areas of Calgary.

-

Increased Demand: Historically, when interest rates drop, demand for homes rises. More people are encouraged to enter the market, which can lead to increased competition for properties. However, Calgary’s growing inventory, especially in newly developed areas, may help balance this increased demand.

-

Investors Take Notice: With borrowing becoming more affordable, investors may also seize this opportunity to expand their portfolios. Rental properties or homes that need a bit of renovation may see more interest, especially in developing neighborhoods with long-term growth potential.

What Buyers Should Consider Going into 2025

Looking ahead into 2025, there are several factors homebuyers should keep in mind as they navigate the real estate market under the new interest rate:

-

Timing Your Purchase: While lower interest rates are beneficial, don’t rush your decision. Take time to review your financial situation, get pre-approved for a mortgage, and consider the total cost of homeownership, including property taxes, maintenance, and insurance.

-

Future Rate Fluctuations: The current rate of 3.75% is a reflection of the Bank of Canada’s current economic policy, but interest rates can fluctuate. Buyers who lock in a fixed-rate mortgage can benefit from the stability of consistent payments, even if rates rise again in the future.

-

Calgary’s Growing Market: As Calgary continues to expand, especially with projections of a population boom by 2048, property values are expected to increase over time. Buying a home now, when rates are lower and prices are competitive, could set you up for long-term financial growth.

Is Now the Right Time to Buy?

The decision to buy a home is a personal one, influenced by your financial situation, long-term goals, and the current market conditions. However, with the Bank of Canada’s interest rate at 3.75%, 2025 presents a unique opportunity for buyers in Calgary. Lower interest rates can provide greater affordability and open up options that may have been previously out of reach.

If you’ve been thinking about entering the real estate market or upgrading to a new home, now may be the perfect time to explore your options. Working with an experienced real estate professional can help you navigate the complexities of the market, find the best deals, and secure a mortgage that suits your budget.

Conclusion: Make the Most of This Opportunity

The Bank of Canada’s rate cut is a game-changer for anyone considering buying a home in Calgary. Whether you’re a first-time buyer or a seasoned investor, the reduced interest rates create favorable conditions to enter the market and make your homeownership dreams a reality.

If you’re ready to take advantage of this historic rate cut and explore what the Calgary real estate market has to offer in 2025, I’m here to help. With over 15 years of experience in the Calgary market, I can provide personalized advice and guide you through every step of the process.

📲 Contact me today to learn more about how the new interest rate can benefit you!

Categories

Recent Posts

GET MORE INFORMATION