Calgary Real Estate Update November 2024

October 2024 Housing Market Update

November 1, 2024

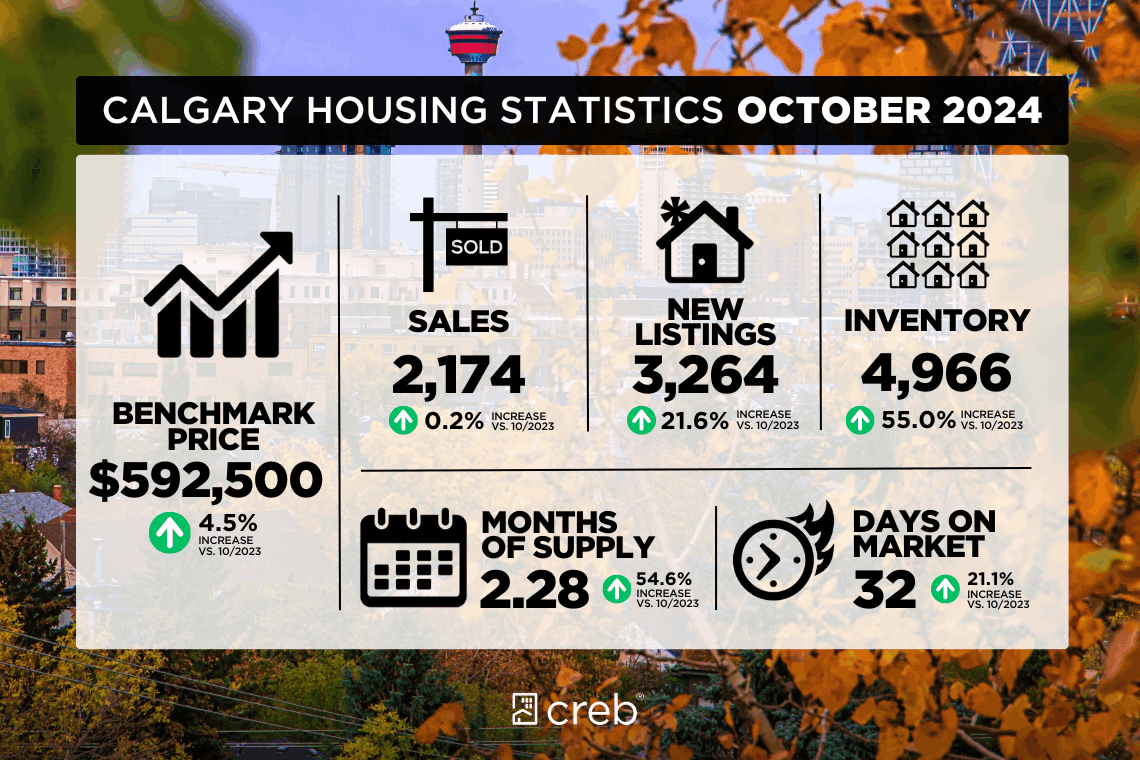

As we move into the fourth quarter, Calgary’s real estate market continues to show resilience, with overall sales in October mirroring last year’s levels. Higher-priced homes saw strong sales gains, offsetting declines at the lower end of the market and keeping October sales above long-term trends. This market snapshot breaks down the latest trends across various property types and regional areas, highlighting the continued impact of inventory shifts, seasonal factors, and changing price dynamics.

Supply Levels Shifting Towards Higher-Priced Homes

According to Ann-Marie Lurie, Chief Economist at CREB®, demand remains steady, but limited lower-priced options continue to restrict activity in that segment. While inventory has grown compared to last year, much of the new supply is concentrated in higher-priced homes across all property types. This has resulted in more balanced conditions for higher-end homes, with lower- to mid-priced segments still operating in a strong seller’s market.

With new listings helping bolster overall inventory levels, the number of available units rose to 4,966 in October—a significant recovery from last October's near-record low of 3,205. However, almost half of the current inventory is priced above $600,000. As a result, the months of supply varies greatly by price range, creating different pressures across the market.

Detached Homes

Detached home sales reached 1,071 in October, marking an increase from last month and a nearly 10% gain year-over-year. Although inventory levels have improved, the months of supply remains low at just over two months, keeping this market favorable to sellers, especially for homes priced under $700,000. The benchmark price for detached homes was $753,900, up 8% from last October, though it showed a slight seasonal dip from last month.

Semi-Detached Homes

October saw a steady increase in semi-detached home sales, up over 6% year-over-year. New listings have kept pace with demand, pushing inventory levels higher and edging this market closer to balanced conditions. However, with only two months of supply, the semi-detached market still leans toward sellers. The benchmark price in October held steady at $677,000, showing an 8% annual increase.

Row Homes

Row home sales have moderated since a strong start to the year, mainly due to supply constraints in homes under $400,000. However, sales in higher price brackets have partially compensated for this drop, with over 70% of transactions now occurring above $400,000. This shift has contributed to an inventory increase, pushing the months of supply above two for the first time since late 2021. The benchmark price for row homes was $456,600 in October, reflecting an 8% rise from last year.

Apartment Condominiums

Sales of apartment condos in October improved over September but marked the fifth consecutive month of year-over-year declines. High lending rates, coupled with limited affordable options, have boosted demand for condos. The current inventory increase in the $300,000–$500,000 range has helped ease price pressures slightly. October’s benchmark price for condos was $341,700, up 11% annually despite a minor seasonal decrease from September.

Categories

Recent Posts

GET MORE INFORMATION