Investing in Real Estate: A Guide for Beginners"

Investing in Real Estate: A Guide for Beginners

-

Educate Yourself:

- Begin by learning the basics of real estate investing. Understand different investment strategies, terminology, and market trends. Resources such as books, online courses, and seminars can be valuable.

-

Set Clear Financial Goals:

- Define your financial objectives and time horizon. Determine if you're looking for long-term appreciation, rental income, or a combination of both. Having clear goals will guide your investment decisions.

-

Assess Your Risk Tolerance:

- Real estate investment comes with risks. Evaluate your risk tolerance and be realistic about your ability to weather potential market fluctuations.

-

Build a Solid Financial Foundation:

- Ensure your personal finances are in order before venturing into real estate. Pay off high-interest debt, establish an emergency fund, and have a stable source of income.

-

Understand Different Investment Strategies:

- Explore various real estate investment strategies such as rental properties, fix-and-flip, real estate investment trusts (REITs), and crowdfunding. Each strategy has its own advantages and risks.

-

Research Local Markets:

- Focus on understanding the real estate market in the area where you plan to invest. Analyze property values, rental demand, and economic indicators to make informed decisions.

-

Network with Experienced Investors:

- Attend local real estate networking events, join online forums, and connect with experienced investors. Learn from their experiences, ask questions, and seek advice.

-

Create a Realistic Budget:

- Develop a budget that includes not only the property purchase but also potential renovation costs, property management fees, and other expenses. Be realistic about your financial capacity.

-

Explore Financing Options:

- Understand the financing options available for real estate investments, including traditional mortgages, private lenders, and creative financing methods. Compare interest rates and terms to find the best fit.

-

Perform Due Diligence:

- Conduct thorough due diligence before purchasing a property. Inspect the property, review financial records, and research the neighborhood to ensure it aligns with your investment goals.

-

Consider Property Management:

- If you're investing in rental properties, decide whether to manage them yourself or hire a property management company. Factor in the costs and benefits of each option.

-

Plan for the Long Term:

- Real estate is generally a long-term investment. Have a strategic exit plan but be prepared to hold onto your investment through market cycles for optimal returns.

-

Stay Informed on Tax Implications:

- Understand the tax implications of real estate investment. Consult with a tax professional to maximize deductions and optimize your tax strategy.

-

Monitor Market Trends:

- Stay informed about market trends, interest rates, and economic factors that can impact real estate values. Adjust your strategy based on changes in the market.

-

Track Your Investments:

- Keep detailed records of your real estate investments, including income, expenses, and property performance. This information will be valuable for future decision-making and tax reporting.

By following these guidelines, beginners can lay a solid foundation for successful real estate investing and navigate the complexities of the market with confidence.

Categories

Recent Posts

#210 - 150 Shawnee Square SW - Sold

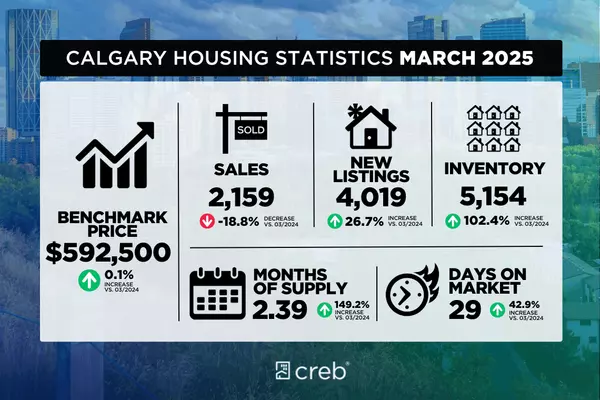

Calgary Market Update March / April

Hot New Listing 2824 38th ST SW - $870,000

Hot New Listing - #210 - 150 Shawnee Square SW

#1203 450 Sage Valley Drive NW - Sold

Hot new listing - #1203 450 Sage Valley Drive NW

Calgary Real Estate Market Update – February 2025

Congrats to my investor client!

Congrats to my long term investor client

Calgary Real Estate Market - Is it now the time to sell?

GET MORE INFORMATION